Investment Offerings

Choose from our three plans and five portfolios

NBF Islamic Investment Solutions include three plans and five portfolios for you to choose from based on your risk approach and investment horizon.

Our multi-asset portfolios and plans invest across a number of funds that invest in turn across several different asset types including equities, bonds and cash. This gives you a greater degree of diversification than when investing in a single asset class.

Below we compare the return versus risk of our three investment plans and five investment portfolios.

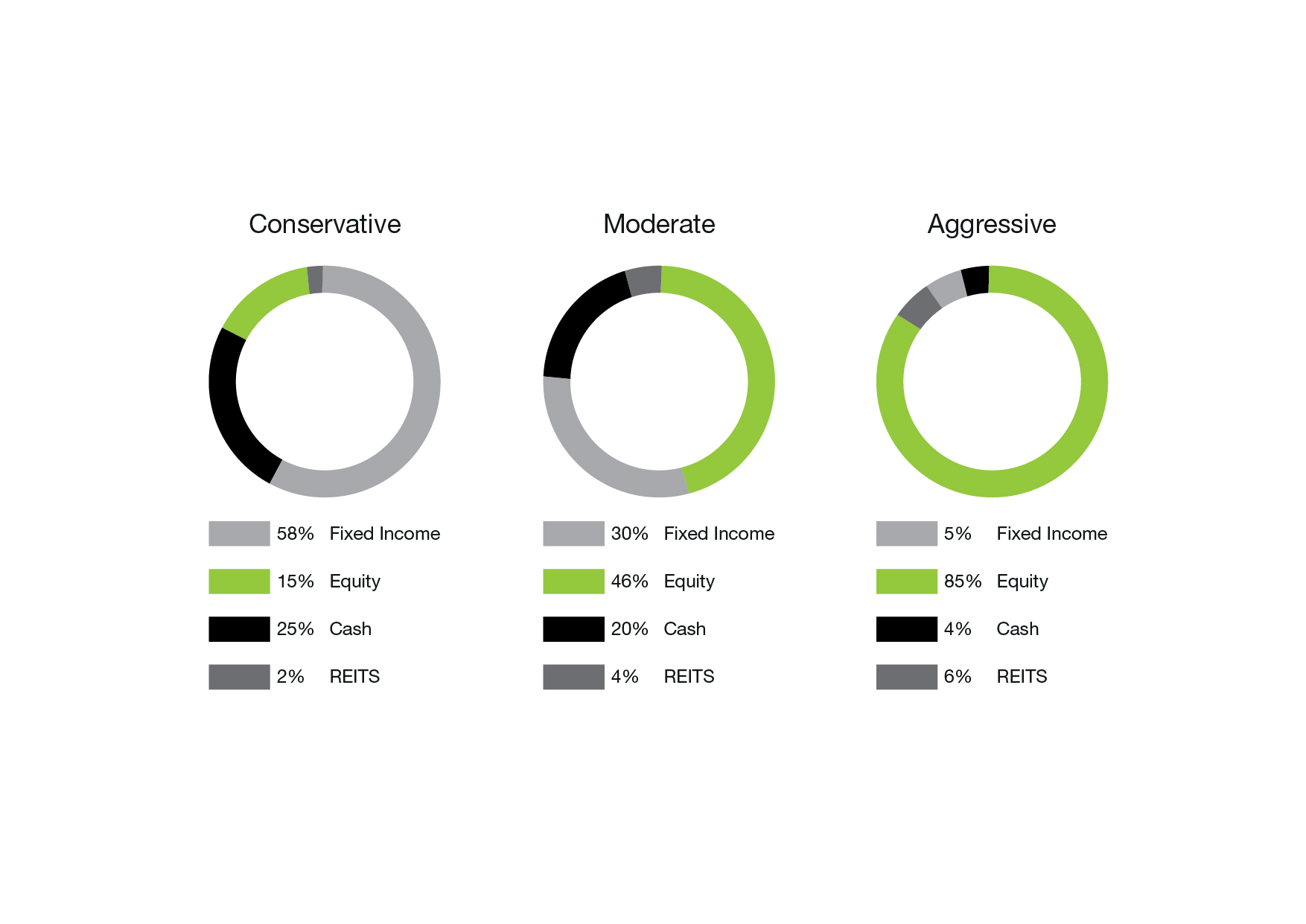

NBF Islamic Investment Plans

Choose from a Conservative Plan, a Moderate Plan or an Aggressive Plan with a minimum of $10,000 in lump sum or $ 1000 in systematic investment.

*Asset Allocation will rebalance periodically.

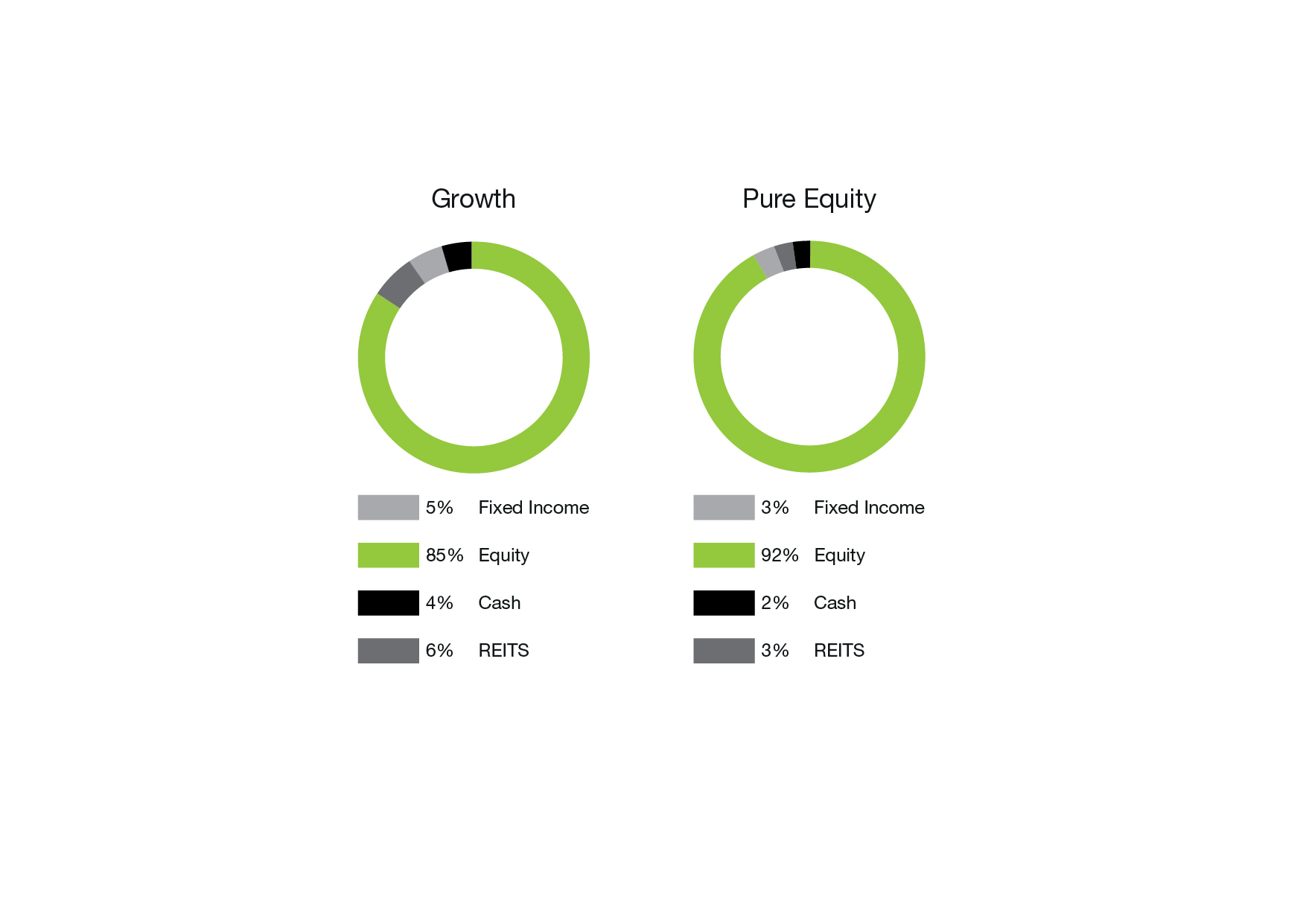

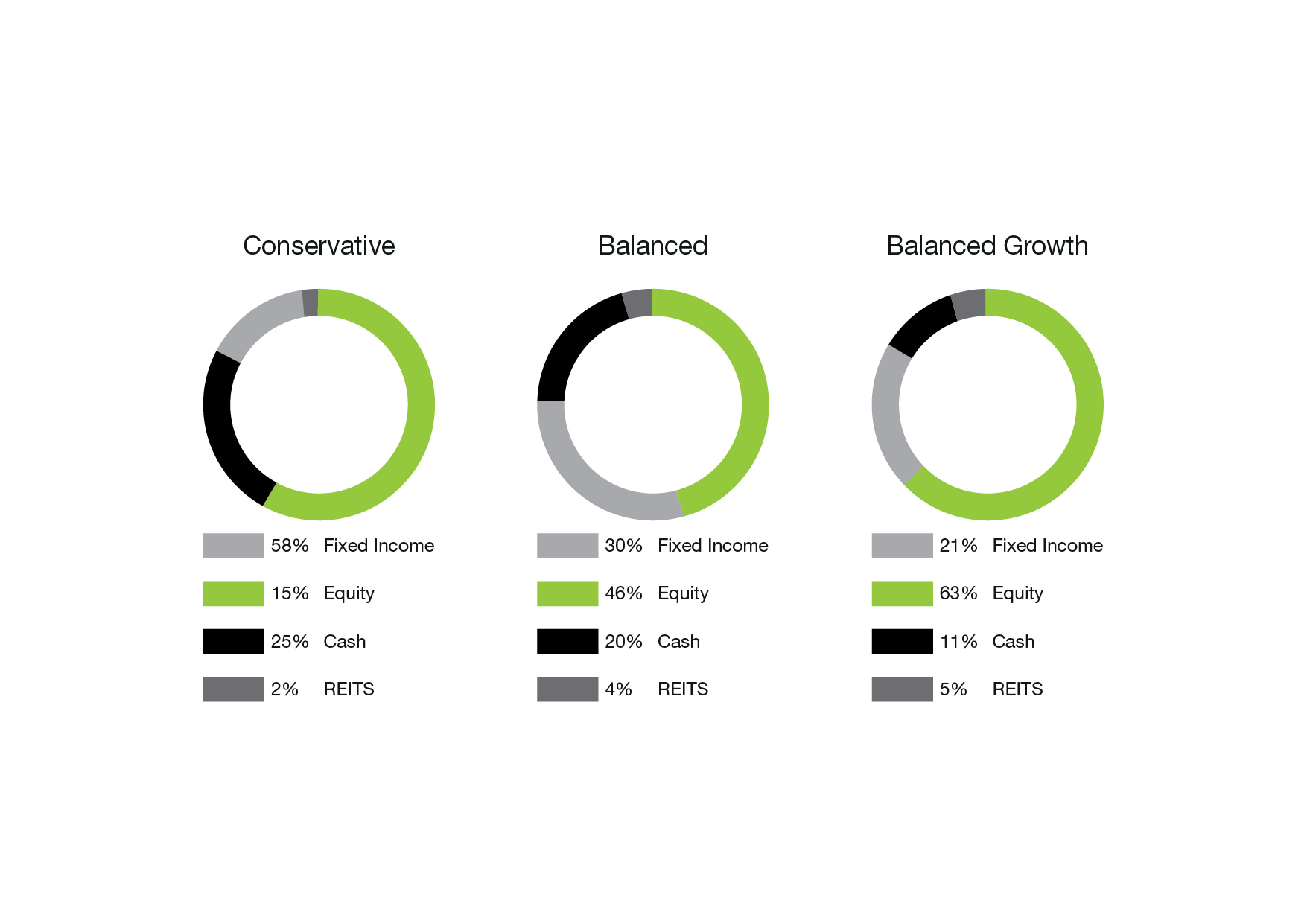

NBF Islamic Investment Portfolios

Select from five NBF Islamic investment portfolios that best suit your investment approach: Growth Portfolio, Pure Equity Portfolio, Conservative Portfolio, Balanced Portfolio or a Balanced Growth Portfolio with a minimum of $25,000 lump sum

*Asset Allocation will rebalance periodically

Why diversification is so important

Diversifying across a broad range of investment strategies, styles, sectors and regions can help cushion the occasional shocks that come with investing in a single asset class. It also enhances the potential for investing in a better performing asset class while spreading the risk of investing in a lower performing asset class.

It has been demonstrated that it is not security or single fund selection that drives long-term returns, but diversification and the dynamic strategic asset allocation that is actually responsible for 90% of long-term performance.

Investors should always remember that diversification does not fully protect you from market shocks and risks.

Source: J.P. Morgan Asset Management- World Stock Market return in local currency